We hope everyone had a wonderful holiday season and a Happy New Year!

2023 Quick Recap:

Looking back at 2023, here are some things that we found very interesting:

- When 2023 started, there was speculation about a potential recession. Instead, the technology sector had one of its best years.

- We saw the rise of the “Magnificent Seven,” which includes Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), Tesla (TSLA), Meta Platforms (META), Microsoft (MSFT), and Alphabet (GOOG).

- The stock market survived the banking crisis we saw earlier in the year with banks like Silicon Valley, First Republic Bank, etc.

- One of the most prominent themes in 2023 was interest rates and inflation, but we have not seen a rate hike since July 2023. The concerns about rate hikes eased in the second half of 2023, and it looks like inflation is trending lower heading into 2024.

- Lastly, and most importantly for Scarecrow strategies, the Nasdaq 100 was up 53.8% at the end of 2023. This was its best year since 1999! (Nasdaq.com, 1/4/2023)

2023 was an excellent year for Scarecrow strategies! Let’s hope we can keep it going throughout 2024.

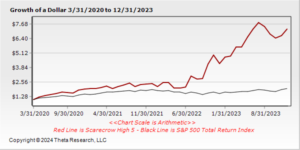

High 5 was much more active than Crow Chaser in the 4th quarter. It bounced between 60-100% Long a few times in October and was very active in November. Unfortunately, there were some inverse and cash trades that worked against High 5, leading to underperformance that month. The trading activity continued in December, dialing back its 100% long exposure to 80% or 60% a few times, but it still caught a good chunk of the Santa Claus rally.

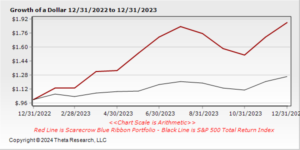

Blue Ribbon is a blended strategy, currently 60% (Crow Chaser) and 40% (High 5). For most of the year, High 5 and Crow Chaser were within 5% of each other. That changed in the 4th quarter when the performance between High 5 and Crow Chaser varied. Below is a chart from Theta Research that shows the net performance of Blue Ribbon in 2023.

Performance Summary at the End of the 4th Quarter 2023:

| Strategy | Gross | Net |

|---|---|---|

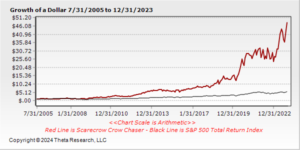

| Crow Chaser | 101.59% | 96.75% |

| High 5 | 74.92% | 70.75% |

| Blue Ribbon | 89.16% | 84.64% |

S&P 500 YTD – 26.27%

Nasdaq 100 YTD – 53.81%

*All Strategies, S&P 500, and Nasdaq 100 through December 31th, 2023.

For more details on our strategies or any inquiries, please email Ben at [email protected].

Advisory Services are offered through Scarecrow Advisors. This summary is for informational purposes only and shall not constitute advice, an offer to sell, or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. The contents of this report should not be relied upon in making investment decisions. The accompanying performance statistics are based upon historical performance and are not indicative of future performance. Past performance is no guarantee of future performance or profitability. The types of investments discussed also do not represent all the securities purchased, sold, or recommended for clients. Stated information is derived from proprietary and non-proprietary sources that have not been verified for accuracy or completeness. While the firm believes this information to be correct, we do not claim or have responsibility for its completeness, accuracy, or reliability. The firm also assumes no duty to update any information in this presentation for subsequent changes of any kind.